P_EOR(COPES) (DOWNLOAD THE LASTEST DEMO)

|

P_EOR(COPES) is a software designed for exploitation engineers to filter different EOR methods for a particular fields. For an new or old field, one needs an economic approach to determine the most suitable method to improve the recovery rate before intensive and expensive field implementation shall be carried out. P_EOR(COPES) can be used for such a filtering processes. Following IOR methods can be filtered including:

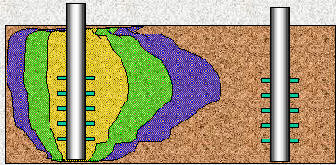

There are such models in P_EOR(COPES): In-Situ Combustion Predictive Model The architecture of the ICPM (In-Situ Combustion Predictive Model) is similar to that of the other predictive models in the series (Paul et al, 1982; Aydelotte and Pope, 1983; Paul et al, 1984): an oil rate versus time function for a single pattern is computed, the results of which are passed to the economic calculations. Data for process costs, reservoir development costs, and operating costs, and a pattern schedule if multiple patterns are desired, allow the computation of discounted cash flow and other measures of profitability. The Polymer Flood Predictive Model The Polymer Flood Predictive Model (PFPM) is switch-selectable for either polymer or water-flooding, and an option in the model allows the calculation of the incremental oil recovery and economics of polymer relative to waterflooding. The architecture of the PFPM is similar to that of the other predictive models in the series: in-situ combustion, steam drive (Aydelotte and Pope, 1983), chemical flooding (Paul et al., 1982) and CO2 miscible flooding (Paul et al., 1984). In the PFPM, an oil rate versus time function for a single pattern is computed and then is passed to the economic calculations. Data for reservoir and process development, operating costs, and a pattern schedule (if multiple patterns are desired) allow the computation of discounted cash flow and other measures of profitability. Estimating Risk The parameter method (Davidson and Cooper, 1976) is used to compute uncertainty in present value. This method deals with the parameters of the probability distributions rather than the distributions and, with reasonable assumptions about distribution form, can estimate the probability of achieving various levels of present value. |